Solarletter #23_EN - IEA Electricity 2025 - Analysis and forecast to 2027

Also: Who Leads the European Storage Market?, Exponential Growth of Photovoltaics in India,

Please note that text below has been translated from the spanish version by using AI

Hello everyone and welcome back to Solarletter. My name is Imanol Matanza, and I aim to share with you the latest news, technological advancements, and trends in the field of photovoltaic energy. Through Solarletter, I hope to provide you with valuable information, market analysis, state-of-the-art updates, and practical tips that will help you stay informed about the latest developments in the photovoltaic industry.

I am always open to suggestions, questions, and comments, so please feel free to contact me. If you like it, don't hesitate to subscribe and share!

Once again, the drafting of the edition becomes complicated. Time is limited, and at the moment I have several ongoing projects, which unfortunately take more time than I would like. Finding the time to sit in front of the computer is sometimes difficult, especially when I do not dedicate much time to reading news from the sector either. Nevertheless, enough with the excuses—let us move on with the second edition of the year.

Alright, let us go with a couple of interesting pieces of news!

IEA Electricity 2025 - Analysis and forecast to 2027

New report from the International Energy Agency (IEA) confirms that we are entering a new era dominated by electricity and the energy transition. Global electricity consumption is expected to grow at a rate of 4% annually through 2027. This represents an increase of around 3,500 TWh per year. To put this into perspective, it would be equivalent to adding Japan's annual electricity consumption.

In this context, solar PV is—and will undoubtedly remain—one of the main pillars of the global electricity system through 2027. Here are some of the reasons why:

Solar PV is expected to surpass all low-emission generation technologies (except hydroelectric power) in terms of net growth.

By 2025, photovoltaic energy will become the second-largest source of clean generation in the world, just behind hydropower.

This growth is driven by the sustained decline in costs, regulatory incentives, and increasing competitiveness compared to other technologies.

China will obviously continue to lead the sector, installing and manufacturing more than any other country. However, accelerated growth is also expected in India, the United States, and Europe, driven by climate goals and the need for energy independence.

With continuously falling costs, the rapid expansion of solar photovoltaic energy is expected to account for approximately half of the growth in global electricity demand through 2027, up from 40% in 2024.

The rapid expansion of photovoltaics will undoubtedly require improvements in transmission systems, including more storage, grid modernization, and better mechanisms to manage variability. In this regard, digitalization and automation will play a key role in the operation of networks with high renewable energy penetration.

_

Who Leads the European Storage Market?

Let us take a look at some battery news. Which European market is currently stronger— the United Kingdom or Germany? Lars Stephan sheds some light on this question in an insightful LinkedIn post, using the following key metrics:

Installed Storage Capacity – Winner: United Kingdom

The UK currently has 6 GW / 8.3 GWh of large-scale storage installed—more than three times that of Germany, which stands at 1.7 GW / 2.2 GWh. However, it is worth noting that Germany also adds another 15.3 GWh in residential storage (according to BSW-Solar), with a 50% increase projected in 2024.

Projects Under Construction – Winner: United Kingdom

The UK boasts 8.2 GW / 18.7 GWh of storage projects under construction, far ahead of Germany, which is currently building only 2 GW / 4 GWh. Though it should be noted that data transparency is somewhat lower for these figures.

Projects Awaiting Grid Connection Permits – Winner: United Kingdom

In Germany, the media refers to a "battery tsunami," with a total of 226 GW awaiting connection permits. However, the UK leads once again, with 557 GW still waiting for grid connection approval.

Annual Battery Revenues – Winner: Germany

This might be the most significant metric of the four. In Germany, BESS systems with a two-hour duration reached or exceeded revenues of €180,000 per MW per year. In contrast, during a weaker year, UK-based projects generated only €72,000 per MW per year.

Lars concludes that the UK market is still around two years ahead, being more mature and allowing storage to benefit from ancillary services and mechanisms such as the Capacity Market. However, Germany is catching up rapidly, showing no signs of market saturation and presenting new opportunities—particularly for hybrid projects.

Both markets have their strengths, but for now, it seems the European storage leadership belongs to the United Kingdom.

_

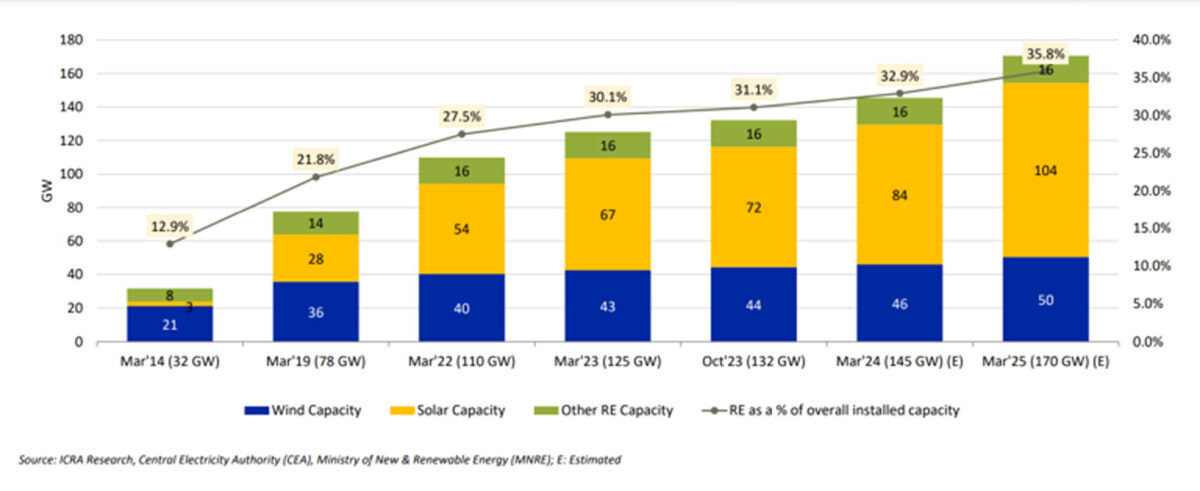

Exponential Growth of Photovoltaics in India

Here is some news from a market that is still relatively unknown in Europe, written by Uma Gupta for PV-Magazine India. In 2024, India achieved an impressive milestone in its photovoltaic sector by adding 25.2 GW of capacity—an increase of more than 204% compared to the 8.3 GW installed in 2023.

Grid-connected solar parks dominated the additions, accounting for 87% of the total (22 GW), while rooftop solar contributed nearly 13% (3.27 GW).

Most of the large-scale solar parks were concentrated in the states of Rajasthan, Gujarat, and Maharashtra, contributing approximately 32%, 27%, and 8% of the installations, respectively. However, despite this milestone, the results could have been even better if not for transmission network issues and supply chain delays. On the other hand, high module prices remain a concern in the sector, according to Raj Prabhu, CEO of Mercom Capital Group. Locally manufactured products are expensive, and imported ones are also costly due to tariffs.

In total, India added 34.7 GW of new capacity from all energy sources in 2024, with solar accounting for nearly 73% of these additions. Although this progress is impressive, Prabhu warned that in order to meet the 2030 targets, more than 35 GW of solar capacity must be installed annually, supported by clear and stable policies that balance local manufacturing with project development.

Despite the obstacles, the 2024 record highlights India's potential to establish itself as a global leader in solar energy.

_

Module Prices Begin to Rise Again

Over the next six months, photovoltaic module prices are expected to once again exceed $0.12/Wp, according to Yana Hryshko in an article by Emiliano Bellini for PV-Magazine. The forecast is that Tier 1 manufacturers' modules will reach between $0.14 and $0.15/Wp before the end of the year, driven by a market reorganization in which many loss-making manufacturers will be forced out.

Up to 300 GW of cell, wafer, and module production capacity may be shut down or converted to other products, mainly from Tier 2 and Tier 3 manufacturers using outdated technologies such as low-efficiency PERC or TOPCon.

Meanwhile, Tier 1 manufacturers, while not reducing production, have limited their capacity to around 650 GW as part of a self-regulation agreement promoted by the Chinese government. This should be enough to meet the expected global demand of 600 to 700 GW.

In addition, the technological transition appears to be advancing faster than anticipated, with manufacturers only announcing new production lines for HJT or back-contact modules. There are no new announcements for TOPCon module lines, and PERC-type modules are expected to be phased out by the end of 2025, or even earlier, according to Hryshko.

This adjustment in production capacity, combined with the increase in polysilicon prices and the need for manufacturers to recover margins, is pushing module prices toward more sustainable levels. Hryshko forecasts that by the end of 2025, prices will stabilize between $0.12/W and $0.15/W, depending on the technology used—marking a return to pre-pandemic levels.

_

Edition´s microtip curiosity

Interesting post by Sergio Relloso on LinkedIn. It could well be a micro tip for this edition too, but since it comes from someone else, I consider it more of a curiosity.

In his post, he discusses how earthworks aimed at increasing production in a photovoltaic plant are not worth the investment. Many clients ask the same question:

Would it not be worthwhile to move a bit more earth to tilt those trackers slightly more to the South so they are not so inclined towards the North? That way, they would produce more.

Obviously, considering single-axis north-south trackers, the more they are tilted towards the South, the better the use of solar energy. In his rough calculation, he adds just a 1% tilt to the surface of a 1 MWp plant with a CAPEX of €600/kWp and a production of 2,000 kWh/kWp:

According to his figures, adding an additional 1% tilt to the South implies a 2.2% increase in CAPEX due to the extra volume of earthworks required. In return, you only get about 0.1% more annual energy production.

This results in an approximate 2.1% increase in LCOE, meaning the energy generated is 2.1% more expensive.

With these numbers, it becomes clear that the increase in investment far outweighs the energy benefit. Therefore, designing earthworks with the goal of maximizing production ends up being a poor economic decision.

That concludes the edition. I hope you enjoyed and it made your coffee break, public transportation ride, or nap more enjoyable. If you have any suggestions, recommendations, or comments, feel free to reply to this email.

If you liked it, help me give it a boost by sharing it on your social media, with your friends, or coworkers. And if you did not like it, I apologize, but returns are not accepted.

Sunny Regards!