Solarletter #20_EN - IEA Renewables October 2024 - Analysis and Forecasts for 2030

Also: South Australia, a Leader in Renewables, Zelestra Acquires a Majority Stake in a German Developer, and Low Prices Strangle Module Manufacturers

Please note that text below has been translated from the spanish version by using AI

Hello everyone and welcome back to Solarletter. My name is Imanol Matanza, and I aim to share with you the latest news, technological advancements, and trends in the field of photovoltaic energy. Through Solarletter, I hope to provide you with valuable information, market analysis, state-of-the-art updates, and practical tips that will help you stay informed about the latest developments in the photovoltaic industry.

I am always open to suggestions, questions, and comments, so please feel free to contact me. If you like it, don't hesitate to subscribe and share!

Alright, let us go with a couple of interesting pieces of news!

IEA Renewables October 2024 - Analysis and Forecasts for 2030

The International Energy Agency has published its October report, and here is a brief summary of their expectations for photovoltaic energy: IEA - Octubre 2024.

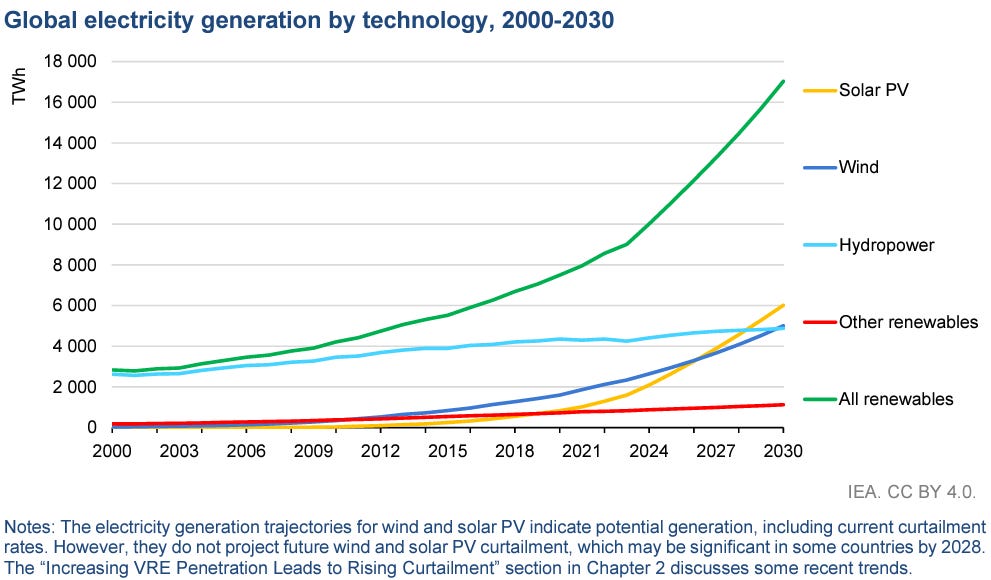

By 2030, global renewable electricity generation is expected to reach over 17,000 TWh, representing an increase of nearly 90% compared to 2023, sufficient to cover the combined demand of China and the United States. Significant milestones will be reached in the next six years:

2024 - the combined generation of solar photovoltaic and wind energy will surpass hydroelectric power.

2025 - electricity generation from renewables will exceed that from coal.

2026 - both wind and solar generation will surpass nuclear.

2027 - solar photovoltaic electricity generation will surpass wind.

2029 - solar photovoltaic will surpass hydroelectric power, becoming the largest renewable energy source.

2030 - solar and wind energy will together account for 30% of global electricity, with photovoltaic leading the renewables. Additionally, wind will surpass hydroelectric power.

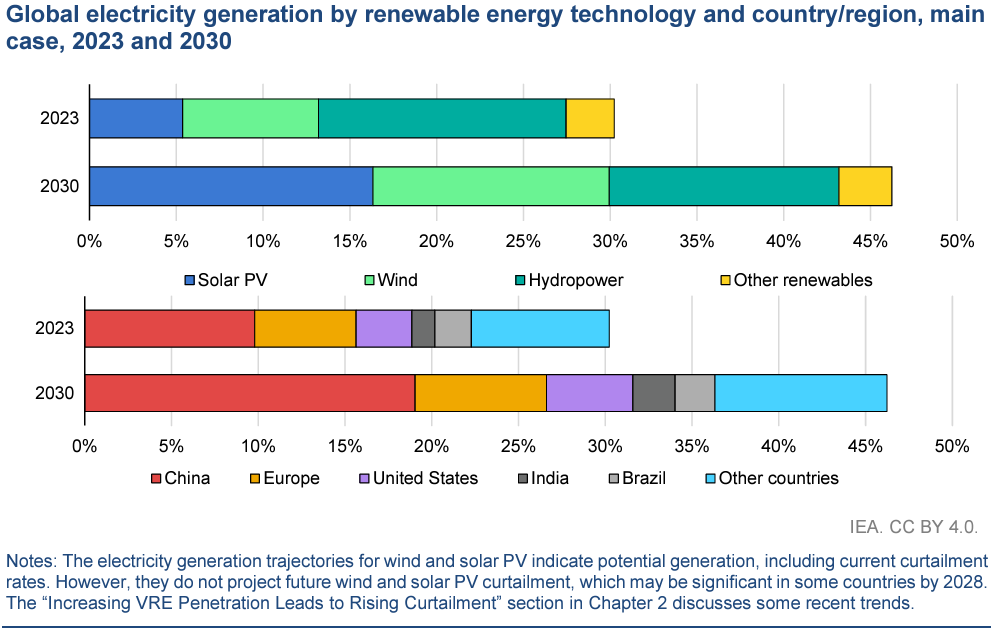

In 2030, renewable energy sources will be used for 46% of global electricity generation, with wind and solar photovoltaic together representing 30%.

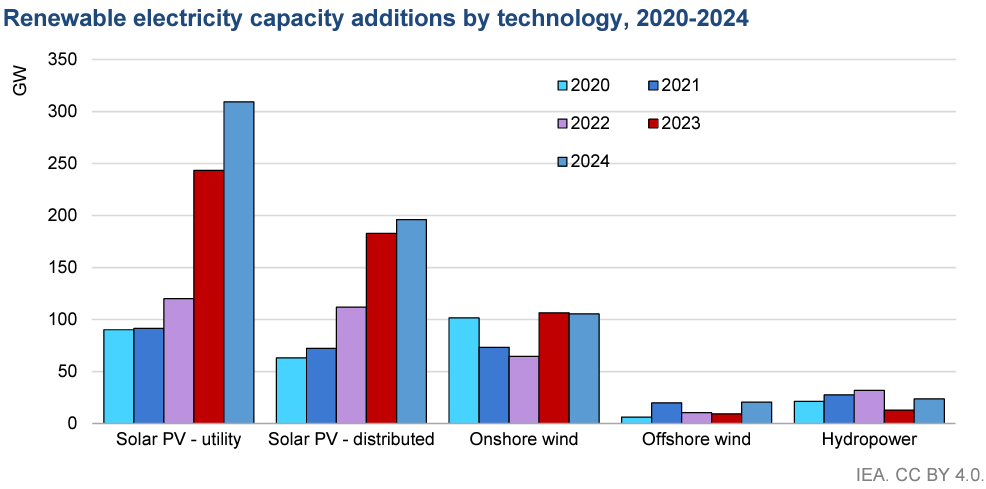

The increase in installed capacity for Utility-Scale projects in 2023 nearly doubled the 2022 value. China played an important role, as the country not only doubled but tripled its capacity. Module prices halved in 2023, and the government implemented a policy to accelerate the construction of large-scale solar photovoltaic plants in desert areas.

The United States recorded the second largest increase, nearly doubling its large-scale photovoltaic installations from 2022 to 2023. Meanwhile, global additions of distributed solar photovoltaic energy (including residential, commercial, and industrial projects) grew by more than 60% last year, driven mainly by acceleration in China and Europe.

After two consecutive years of decline, onshore wind energy installations rebounded by 65% to 107 GW in 2023, with growth again concentrated in China and, to a lesser extent, in India, while additions remained stable in Europe and decreased in the United States.

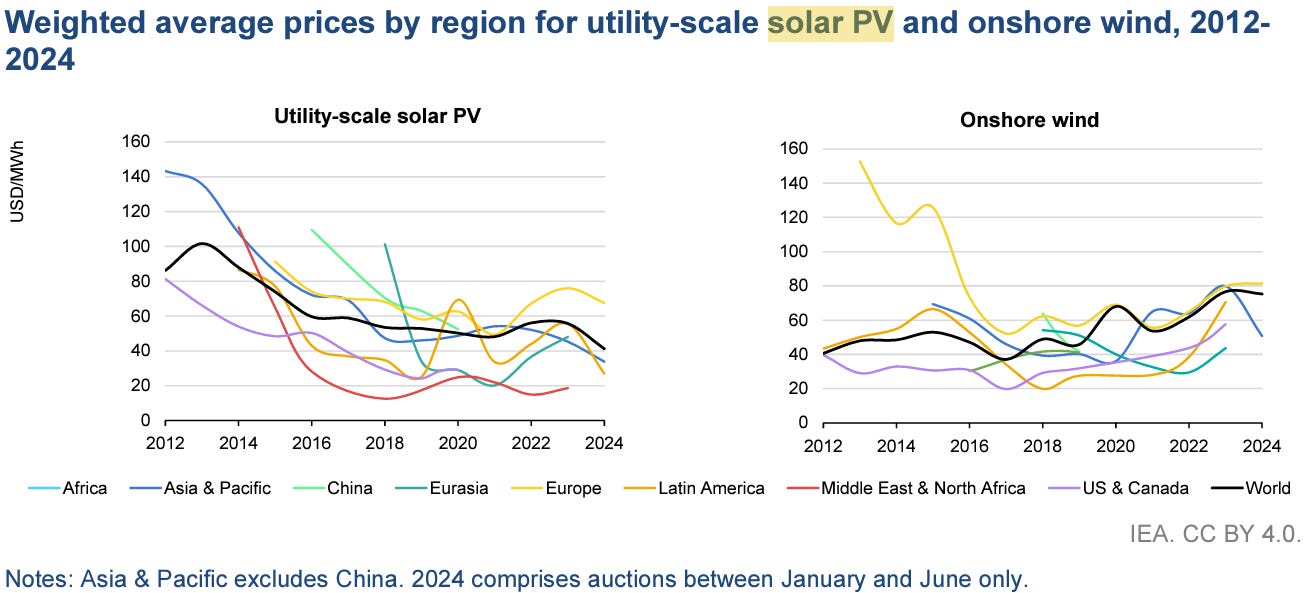

Solar photovoltaic (PV) energy contract prices continue to decline, while inflationary pressure persists for onshore wind energy. Over the past decade, average auction prices for utility-scale solar projects have continuously decreased in all regions, reaching an average of 40 USD/MWh in the first half of 2024. This decline is largely due to India, a leader in awarded capacity, with an auction price of 34 USD/MWh. In contrast, Europe obtained an average price of 67 USD/MWh for awarded projects in 2024, reflecting an 11% reduction.

This leads to an expected 7% decrease in annual capacity additions in Europe in 2024 compared to 2023, primarily due to reduced incentives for solar photovoltaic energy in Poland and lower auction volumes in Spain. The expansion of distributed solar photovoltaic energy is also slowing in Spain and remaining stable in Germany, as lower electricity prices make it less economically attractive than in 2022, when Russia's invasion of Ukraine caused an increase in retail electricity prices.

_

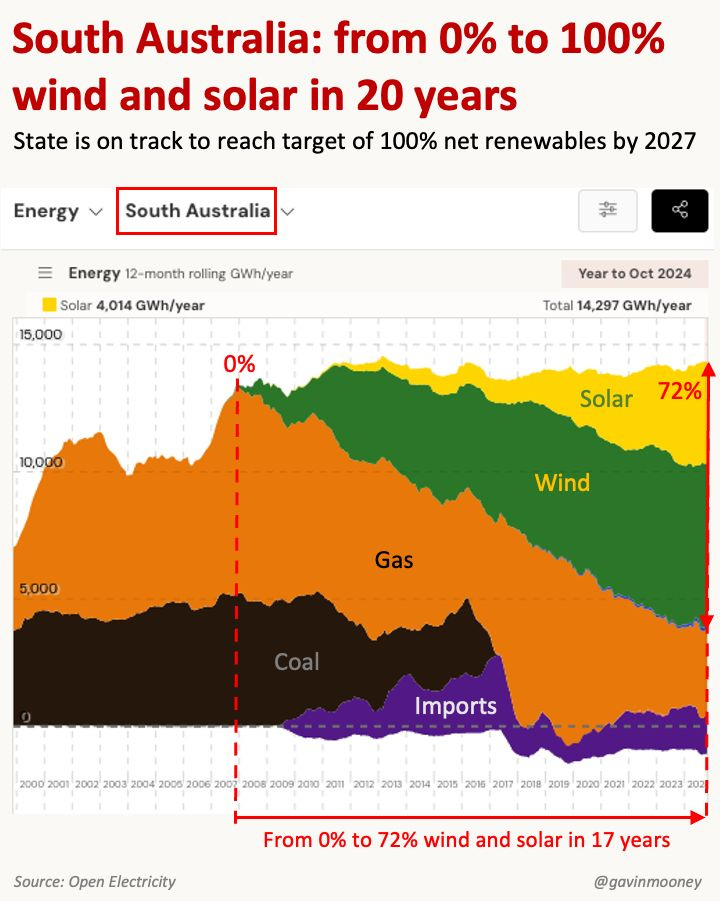

South Australia, a Leader in Renewables

Interesting post by Gavin Mooney where he shares data on the electricity generation park in South Australia. It has moved from 0% renewables in 2007 to 72.1% in 2024, excluding hydroelectric power. The trend shows a continuous advancement of wind and solar energy, while gas will play an increasingly smaller role, serving to cover the shortfalls of the former.

On the other hand, he highlights that interconnection with other electricity markets will continue to be crucial.

For comparison, only Denmark shows a similar level of renewable energy, although in its case, interconnections with surrounding countries can sometimes allow it to meet electricity demand with renewable energy.

The Australian state plans to achieve 100% “net renewables” by 2027 through the following measures:

Adding an additional 1 GW of wind and photovoltaic capacity.

Adding 400 MW/1,600 MWh of storage.

Construction of the Project Energy Connect interconnection, which will double import and export capacity.

Moreover, new industrial consumers are expected, with inquiries for an additional 2,000 MW ranging from mining to data centers, which will reduce transmission costs by improving grid usage. Additionally, this could require 6,000 MW more of renewable energy.

_

Zelestra Acquires a Majority Stake in a German Developer

Zelestra, formerly known as Solarpack and based in Getxo, is a Spanish company dedicated to the development, construction, and operation of renewable energy. It is now expanding its presence in the German market by acquiring a majority stake in East Energy GmbH, a German developer based in Rostock.

The acquisition, which includes a 25% stake, adds a project portfolio of over 2 GW in photovoltaic energy, batteries, onshore wind energy, and Power-to-X technologies (for those unfamiliar with this term, it refers to processes that convert electricity into other forms of energy, such as hydrogen or synthetic fuels. Here a link) to Zelestra’s portfolio.

This strategic move strengthens Zelestra’s plans to become a major independent power producer (IPP) in Europe’s largest energy market, focusing on developing, constructing, and operating these projects.

Robert Hienz, CEO of Zelestra in Germany, emphasized that this collaboration will accelerate the energy transition and align with the country’s renewable energy goals, highlighting the importance of sustainable and advanced solutions.

It appears that while other European markets are beginning to show signs of saturation, the German market remains attractive to many companies. In Solarletter #10, we outlined some of the reasons for this. Prosolia Energy also began its ventures in Germany in 2024 (elEconomista).

_

Low Prices Strangle Module Manufacturers

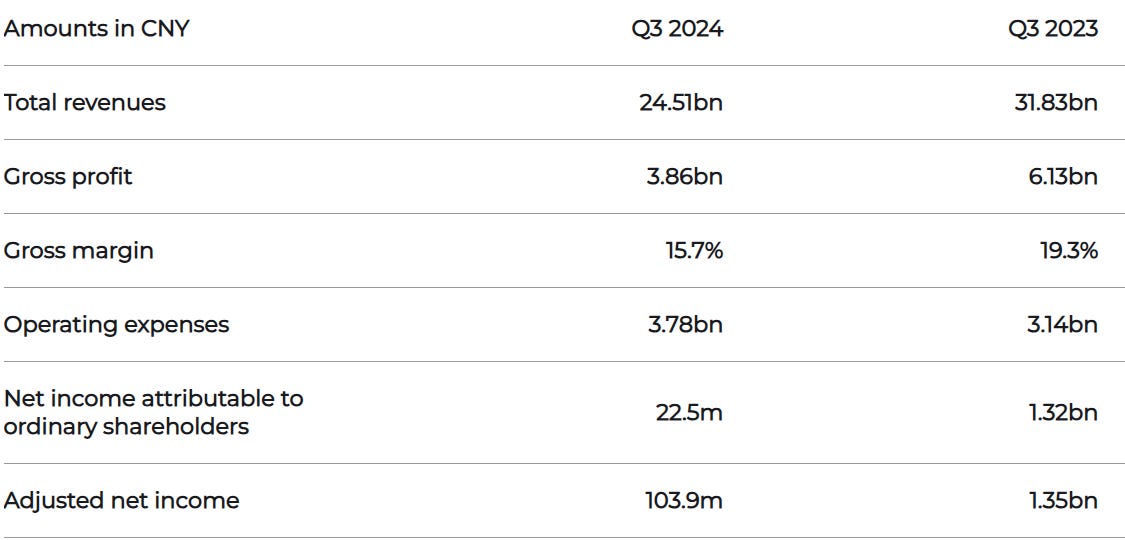

JinkoSolar, the Chinese solar module manufacturer, reported lower financial results for the third quarter due to the ongoing decline in photovoltaic module prices, despite an increase in shipments (as reported by Renewables Now). The company revised its 2024 shipment forecast, now expecting between 90 GW and 100 GW instead of the previous range of 100 GW to 110 GW. For the fourth quarter, it anticipates shipments between 22.3 GW and 32.3 GW, compared to 25.9 GW in the third quarter.

Total revenue for the third quarter was 24.51 billion CNY (3.44 billion USD), representing a 23% year-on-year decline due to continuously dropping and “unrestrained” prices.

CEO Xiande Li highlighted that, despite industry-wide profit pressure, JinkoSolar achieved relatively solid results thanks to its leading position in N-type TOPCon technology and its global sales and manufacturing network. The company forecasts that by the end of 2024, its annual production capacity will reach 120 GW in mono wafers, 95 GW in solar cells, and 130 GW in solar modules.

However, it is not just reduced profits affecting manufacturers—as early as July, major producers reported losses for the first half of 2024. These included Tongwei, Aiko solar, and even LONGi (reported by PVTech).

Gerard Scheper, CEO of European Solar, told PVEurope that overcapacity is the biggest issue, and only an increase in demand or a reduction in supply could stabilize the market. The Chinese government’s measures, such as the ban on increasing production capacity, aim to mitigate the situation, but uncertainty remains, with potential bankruptcies among major producers as a possible outcome.

_

Edition´s microtip

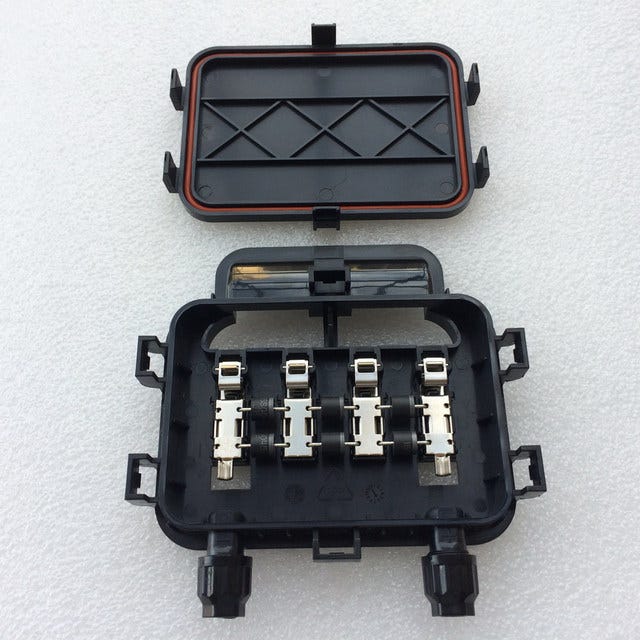

In this edition, we are going to delve into the junction box of photovoltaic modules. I am including a photo below to see if you can guess what it is:

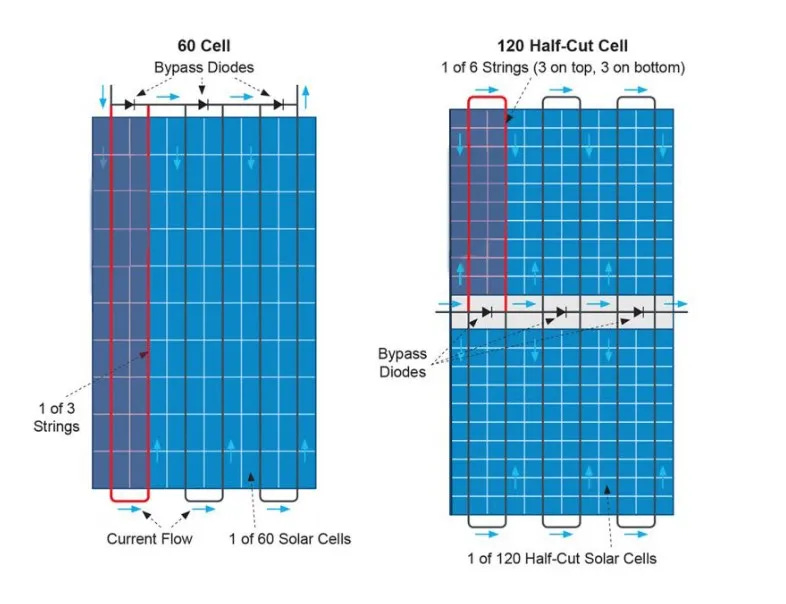

Exactly, today we are discussing bypass diodes, which serve to protect the panel and optimize its performance when part of it is shaded or damaged. These diodes are connected in parallel within the junction box, and their function is to divert the electrical current from the series strings of cells that cannot generate sufficient energy, preventing them from acting as resistors that could cause losses and potentially damage the module in the worst-case scenario.

I personally like to compare electricity to water, as it helps visualize its complexity and behavior. Just like water, electricity seeks to flow through the simplest path or the path with the least resistance.

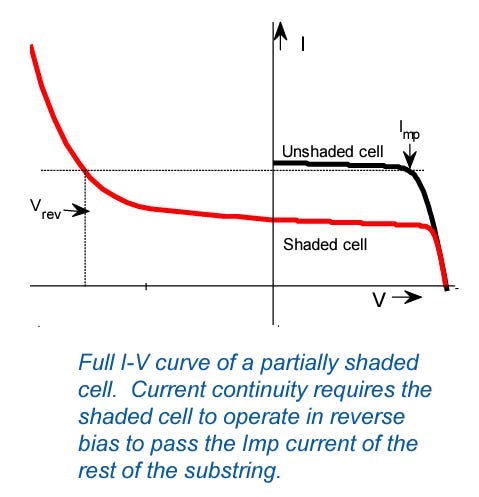

When a photovoltaic cell is damaged or shaded, it will switch from generating electricity to potentially consuming it (this will depend on the operating point):

Everything will depend on the negative effect that this shading or damage has. The current passing through the diode will lose around 0.6 V. If the loss incurred by flowing through the string of cells results in a greater loss, the electricity will prefer to pass through the diode and incur that cost.

Thus, the use of bypass diodes minimizes energy losses and extends the useful life of the module, as it prevents the formation of hot spots that can damage the cells. Although the total output of the panel decreases when a bypass diode is activated, the impact is limited to the shaded section, allowing the rest of the module to continue functioning efficiently. Here is a very illustrative video.

In the video, you can observe the difference between conventional modules and the newer half-cut cell modules. We have already discussed these and their advantages over conventional ones in Solarletter #15.

That concludes the edition. I hope you enjoyed and it made your coffee break, public transportation ride, or nap more enjoyable. If you have any suggestions, recommendations, or comments, feel free to reply to this email.

If you liked it, help me give it a boost by sharing it on your social media, with your friends, or coworkers. And if you did not like it, I apologize, but returns are not accepted.

Sunny Regards!