Solarletter #11_EN - How is the 'Made in Europe' manufacturing capacity performing?

Also: Monthly Photovoltaic Generation by Province in Spain, New robot for O&M tasks in photovoltaic parks and New drops in photovoltaic module prices

Please note that text below has been translated from the spanish version by using AI

Hello everyone and welcome back to Solarletter. My name is Imanol Matanza, and I aim to share with you the latest news, technological advancements, and trends in the field of photovoltaic energy. Through Solarletter, I hope to provide you with valuable information, market analysis, state-of-the-art updates, and practical tips that will help you stay informed about the latest developments in the photovoltaic industry.

I am always open to suggestions, questions, and comments, so please feel free to contact me. If you like it, don't hesitate to subscribe and share!

Leaving behind the emotional aftermath of the last edition, let us dive into the final edition before this Christmas. From here, I wish you a joyful holiday season surrounded by your families, friends, and loved ones, and a prosperous entry into 2024!

Let us hope that the coming year brings along significant milestones in the photovoltaic sector so that we can share them with you in Solarletter!

How is the 'Made in Europe' manufacturing capacity performing?

The European Union has set a goal of achieving an annual production capacity of 30 GW by 2030 for all key components of photovoltaic energy, especially inverters and photovoltaic modules (Q2-2023 report here). The conflict in Ukraine has highlighted the risks of depending on third-party countries for energy, leading to a shift away from fossil fuels to renewables to reduce dependence on countries like Russia, but also raising concerns about reliance on another major player, China.

The growth of solar energy in Europe has contributed to an increase in the production capacity of inverters, cells, and modules in 2023. The European Union saw a rise in annual manufacturing capacity by 10 GW, 0.6 GW, and 5 GW, respectively. However, the capacity for polycrystalline silicon production has decreased by 12% between the manufacturing of ingots and wafers, reducing its annual capacity to 1 GW and 1.2 GW.

But where does this production capacity stand in comparison to the installation pace in the EU? SolarPower Europe recently released its EU Energy Outlook, analyzing the roadmap for installation and component manufacturing from 2023 to 2027. As their analysis shows, having almost finished 2023, the installation rate seems to have surged by 40% compared to 2022, reaching a record figure of 56 GW in a year.

Nevertheless, despite expectations of a higher installation rate in 2024, challenges such as connection permit issues, bureaucratic delays, labor shortages, lack of storage, and inflation could act as impediments. SolarPower Europe anticipates an approximately 11% increase in the installation rate, reaching 70 GW annually, thus meeting the average speed required to achieve European goals by 2030.

Returning to the figures of "Made in Europe" production capacity, this would represent only 2% of manufacturing. On the SolarPower Europe website, there is an interactive map featuring key players in "Made in Europe." Here, you can observe that Europe already possesses a significant production capacity for inverters. However, the question arises: Is the power electronics inside these inverters also European, or are they simply assembled in Europe? If there are any manufacturers among the readers, they might provide some insights :P

Last week, EU members convened to discuss the Net-Zero Industry Act (NZIA), an instrument intended to support European manufacturers. This initiative aims to replicate the U.S. Inflation Reduction Act (IRA), which we discussed in Solarletter #6. Among its measures or intentions are attracting investments, improving and preparing the workforce, and creating a platform for sharing information among various countries and market stakeholders.

Will we see more concrete measures in 2024? Will their measures come too late?

_

Monthly Photovoltaic Generation by Province in Spain

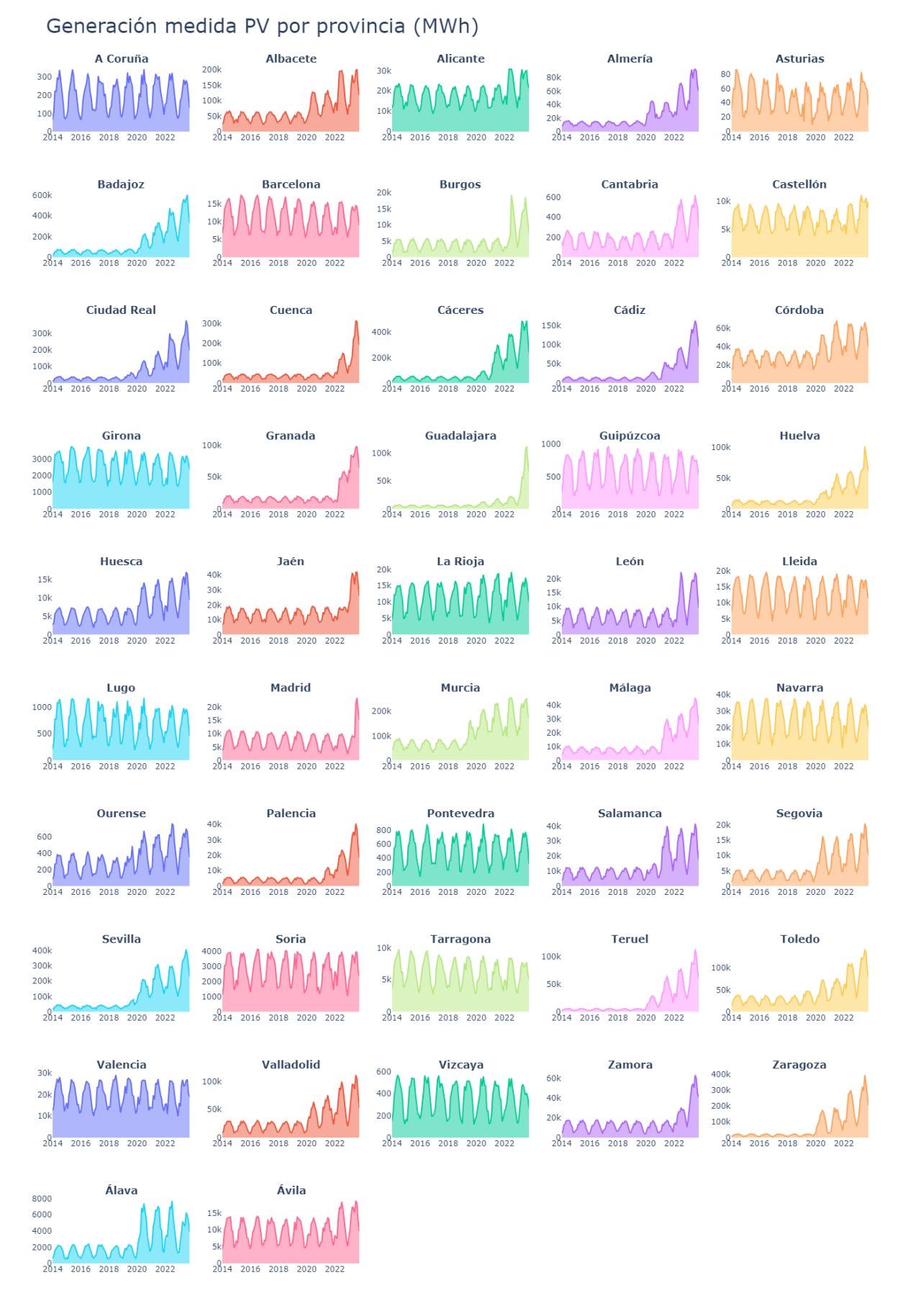

A couple of weeks ago, I came across a post by Rodrigo García Ruiz. In it, he displayed the photovoltaic energy production by province using Python and data from the Red Eléctrica Española (REE) since January 2014.

In case you do not want to spend much time on the graph, Rodrigo divides the provinces into 3 different types:

Those with constant production where no evolution in production levels is observed over the years. A Coruña, Asturias, Castellón, Guipúzcoa, La Rioja, Pontevedra, Soria, Valencia...

Those with a boom in production: Almería, Badajoz, Cáceres, Cádiz, Guadalajara, Huelva, Murcia, Seville, Teruel, Toledo, Zamora, Zaragoza...

Those with a slight decrease in production: Barcelona, Girona, Lugo, Tarragona, Vizcaya...

Certainly, it is interesting that Catalan provinces, despite having high energy demand due to industry and good solar irradiation values, have not grown as much as others. It seems that public administration and its inability to process permits on time might have something to do with it. I will leave you this interesting article by Carles Huguet from elEconomista if you want to investigate further.

_

New robot for O&M tasks in photovoltaic parks

The company Arbórea Intelbird, based in the Spanish city of Salamanca, has developed the Antecursor II, a robot capable of remotely and autonomously performing O&M tasks for large photovoltaic parks.

Pilar Sanchez, from PV-Magazine, reports that it is constructed with aerospace alloys, weighs 285 kg, and has a 30-hour autonomy. Equipped with thermographic equipment for inspecting the modules both from above (similar to drones) and from below, it can also check other critical points in photovoltaic installations, such as clips, DC cables, connectors, fuses, etc.

The system uses an AI developed by the same company to autonomously detect anomalies and report them in real-time, thus enabling rapid detection and facilitating the corresponding corrective maintenance. Additionally, the robot is equipped with a clearing system, allowing it to "mow the lawn" while moving through the park.

Furthermore, the communication system is supported by the Starlink network, allowing proper monitoring of the fleet, even in remote regions with poor connections.

_

New drops in photovoltaic module prices

In this edition, similar to Solarletter #6, we once again discuss the slide in which photovoltaic module prices currently find themselves. OPIS, a market information provider, shares the following graph in PV-Magazine. A picture is worth a thousand words:

The prices of Chinese photovoltaic modules have hit a new record low, with Mono-Perc modules reaching 0.123 $/Wp (0.11 €/Wp), decreasing by 0.003 $/Wp compared to the previous week. On the other hand, TOPCon modules plummet by 0.004 $/Wp to 0.131 $/Wp (0.12 €/Wp).

Are module manufacturers heading into a battle for the lowest prices? Could something similar to the OEMs in the wind energy sector occur?

As Sergio Fernández typically analyzes in his Windletter #59, OEMs in the wind energy sector have also gone through a similar price war.

_

Edition´s microtip curiosity

As we saw in the first news, the EU aims to improve its capacity for producing photovoltaic components. However, the price drops seen in the last news don't help at all...

So, what price should a "Made in Europe" module have? I will leave you the answer to this question by Karl-Heinz Remmers in PV-Magazine. As a summary, his cost estimates for a 575 Wp TOPCon module would be:

7 c€/Wp for Topcon cells (including transportation to the EU).

6.5 c€/Wp for all other materials (Bill of Materials, BOM).

4 c€/Wp for manufacturing.

Therefore, the total costs would amount to 17.5 c€/Wp. Although these costs do not include the glass tariff. Without the glass tariff and in manufacturing in a Balkan country, the module would cost only 15.7 c€/Wp.

As we mentioned in Solarletter #2 in June, Exiom Solution S.A. started the construction of its module factory in Langreo, Asturias. Here's a video with an update on how the works are going:

That concludes the edition. I hope you enjoyed and it made your coffee break, public transportation ride, or nap more enjoyable. If you have any suggestions, recommendations, or comments, feel free to reply to this email.

If you liked it, help me give it a boost by sharing it on your social media, with your friends, or coworkers. And if you did not like it, I apologize, but returns are not accepted.

Sunny Regards!