Solarletter #13_EN - Spain, the preferred country for PPAs in Europe

Also: Arctech wins a historic order of 1.7 GW in Saudi Arabia, The birth of a megaproject and Meyer will stop manufacturing modules in Germany.

Please note that text below has been translated from the spanish version by using AI

Hello everyone and welcome back to Solarletter. My name is Imanol Matanza, and I aim to share with you the latest news, technological advancements, and trends in the field of photovoltaic energy. Through Solarletter, I hope to provide you with valuable information, market analysis, state-of-the-art updates, and practical tips that will help you stay informed about the latest developments in the photovoltaic industry.

I am always open to suggestions, questions, and comments, so please feel free to contact me. If you like it, don't hesitate to subscribe and share!

Before starting with the editing, I would like to share some good news with you all, especially those who follow Solarletter in English. Windletter, the newsletter for the wind market, has just been launched in English! So, if you're interested in getting to know the photovoltaic companion, feel free to subscribe. Here's the link:

Alright, let us go with a couple of interesting pieces of news!

Spain, the preferred country for PPAs in Europe

In the last edition, Solarletter #12, we discussed the market analysis conducted by Pexapark for the year 2024. This time, José Alfonso García Jiménez shares some key points about the report:

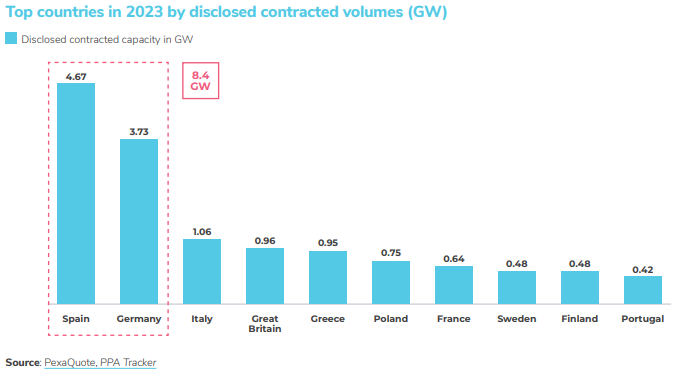

In 2023, there were 272 agreements closed, totaling 16.2 GW, representing a 40% increase compared to 2022.

Solar pv energy accounted for nearly 70% of these agreements.

For the fifth consecutive year, Spain led in the volume of agreements, reaching 4.67 GW. Alongside the 3.73 GW closed in Germany, they account for 51% of the volume in Europe.

Sweden, Greece, and Portugal made their debut in the Top 10.

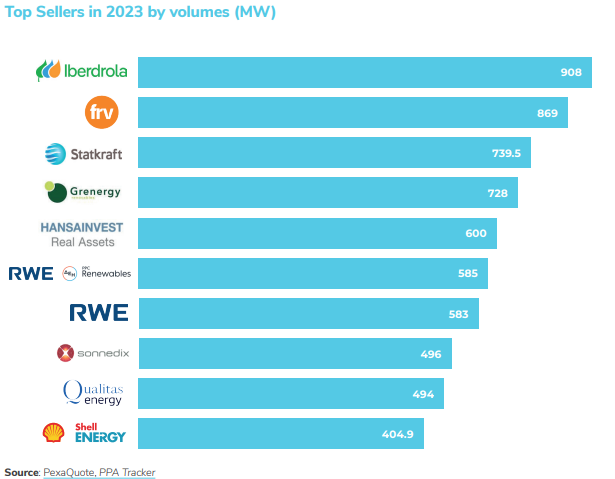

Iberdrola, with 908 MW, became the leading seller.

Amazon acquired a total of 1.876 GW through seven agreements.

They also highlight that in 2023, the first fully unsubsidized hybrid PPA, involving battery storage, was closed in the United Kingdom.

Certainly, this marks the beginning of many projects in the future given the strong renewable penetration.

_

Arctech wins a historic order of 1.7 GW in Saudi Arabia

Archtech is gaining momentum globally, boasting a 1.7 GW order portfolio spread across two projects in Saudi Arabia. The AR RASS2 project, with a capacity of 1.3 GW, and the Al Kahfah project, with 408 MW, are currently in the delivery stage.

In these projects, they deploy their Skyline II tracker, a single-axis tracking system in 1P (one module in portrait/vertical). These trackers operate even in wind gusts of up to 22 m/s and claim to increase park efficiency by 8% through their AI algorithm.

The AR RASS2 and Al Kahfah projects mark the first collaboration between Arctech and the global EPC company, L&T, which has extensive experience in electrical infrastructure and recent developments in renewable energy.

While data for the 2023 tracker market is not available, below is a chart from Taiyang News illustrating the leading tracker manufacturers globally in 2022.

The use of trackers is not a new concept, dating back to 2008 with the onset of photovoltaics in Europe. During those times, especially with dual-axis trackers, when module prices were around €3/Wp, it was crucial to maximize production per kWp. However, the landscape has changed. The standardization of the tracker market with north-south tracking systems and 1P configurations has led to a decrease in prices, improving the overall project performance.

In future editions, we will delve deeper into the advantages and characteristics of trackers. If you do not want to miss out, make sure to subscribe.

_

The birth of a megaproject

We are back with another record! Solar Philippines claims to have initiated the construction of what will be the world's largest photovoltaic park, boasting a capacity of 4 GWp. Yes, you read that right—this project is set to be twice as large, TWO times larger, than the current largest photovoltaic park in the Emirates(for more details, check Solarletter #10).

Solar Philippines, the listed company of the Filipino module manufacturer and project developer SP New Energy Corp. (SPNEC), confirmed today that it has started land clearing for its flagship development, Terra Solar, with a capacity of 4 GW in Nueva Ecija and Bulacan, located in northern Philippines.

The plan involves expanding a park in Luzón from 500 MW, multiplying the power of the initial project by eight.

Additionally, the photovoltaic project will be accompanied by a 4 GWh storage facility. It is expected to be completed by 2026.

_

Meyer will stop manufacturing modules in Germany.

The German manufacturer, Meyer Burger, will cease the production of HJT photovoltaic modules, according to pv-magazine. However, it will continue the production of photovoltaic cells to support its manufacturing operations in its future 2 GW production facility in the United States (could IRA have something to do with it? Solarletter #6).

In a market where Chinese manufacturers continue to lower their prices, it is challenging to compete. Meyer's executives state that "continuing large-scale European solar manufacturing is currently not sustainable."

The closure of its factory in Freiberg puts 500 jobs at risk, although the final decision will be made at the end of February, pending "sufficient measures to create a level playing field in Europe, such as a resilience compensation system."

Before this announcement, Meyer Burger aimed to achieve approximately 3 GW of new annual production capacity in Germany by the end of 2024, including 1.4 GW of module production capacity in Freiberg. They also have current plans to build a 3.5 GW solar cell and module factory at an unspecified location in Spain.

It is important to recall that the European Union aims for an annual production capacity of 30 GW for all key components of photovoltaic energy by 2030 (Solarletter #11).

_

Edition´s microtip curiosity

Today I come back with a new curiosity from a post by Alejandro Diego Rosell. Did you know at what altitude the highest-altitude photovoltaic park is located? Well, it is situated on the Tibetan Plateau in China, at an elevation of 5,100 meters. It has a capacity of 300 MWp, and they claim to have exceptionally high yields, where sunlight hours and low temperatures help enhance its production.

In the video, they mention that it generates 90 GWh annually, and as they were discussing its excellent performance, I thought about calculating its annual production per kWp, 300 kWh/kWp... I do not know, but I think something is amiss here, Rick...

Nevertheless, it is interesting to know what kind of challenges they might have faced in its design and construction. Here are some that come to mind:

Wind gusts might be higher at those altitudes, so what kind of structure would they have had to use?

The atmospheric conditions could be different; is it a more corrosive or milder environment?

How to transport so many components to one of the most sparsely populated regions in China? Did they have to make a significant investment in civil and electrical infraestructure?

Did they already have reliable meteorological data for that location?

Construction likely required many workers; were there enough accommodations in the area for everyone, or did they have to create them?

Can you think of any more? Leave them in the comments 😊

That concludes the edition. I hope you enjoyed and it made your coffee break, public transportation ride, or nap more enjoyable. If you have any suggestions, recommendations, or comments, feel free to reply to this email.

If you liked it, help me give it a boost by sharing it on your social media, with your friends, or coworkers. And if you did not like it, I apologize, but returns are not accepted.

Sunny Regards!