Solarletter #12_EN - How did the photovoltaic sector performed in 2023?

Also: Analysis by Pexapark for the year 2023, Curiosity - Water drainage clips for pv modules, and Union of manufacturers to standardize 700 W modules

Please note that text below has been translated from the spanish version by using AI

Hello everyone and welcome back to Solarletter. My name is Imanol Matanza, and I aim to share with you the latest news, technological advancements, and trends in the field of photovoltaic energy. Through Solarletter, I hope to provide you with valuable information, market analysis, state-of-the-art updates, and practical tips that will help you stay informed about the latest developments in the photovoltaic industry.

I am always open to suggestions, questions, and comments, so please feel free to contact me. If you like it, don't hesitate to subscribe and share!

As we discussed in Solarletter #5, many solar projects in Spain were in jeopardy due to the administration's inability to analyze and review all applications. The Spanish government has finally decided to extend the milestones and give a lifeline to all those projects that were hanging by a thread. If you want to know more, this excellent post by nTeaser explains it brilliantly.

After the Christmas break and with a couple of extra kilos, we are back with a new edition. This time, in the edition's tip, I discuss something more technical. So stay tuned until the end to discover it!

How did the photovoltaic sector performed in 2023?

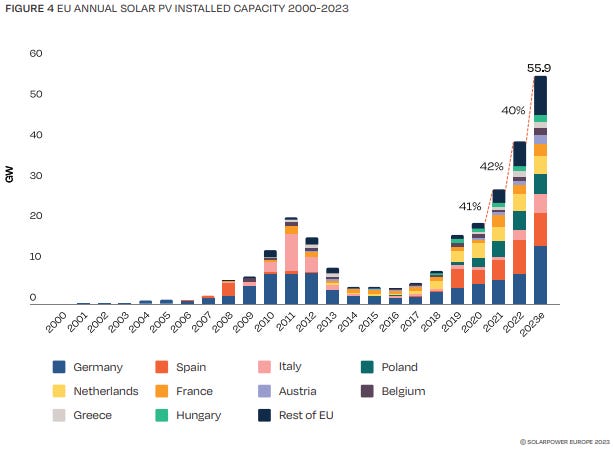

This first section has quite a few graphs, so I will try not to write much to allow you to concentrate on analyzing them. All of them come from the EU Market Outlook for Solar Power report by Solar Power Europe, a source I have used several times. The report is dense, but it contains a wealth of interesting data and predictions.

How much power has each country installed during the period from 2000 to 2023?

What is their prediction for 2027?

What is the accumulated capacity by country in the period 2000-2023?

What is their prediction for 2027?

Which have been the most important markets in the last two years?

Which ones will be the most important by 2027?

And let us go with the last graph, perhaps not the most interesting, but certainly the most curious. Which European citizens have more incentives are more environmentally friendly?

And you, what do you think? Will we meet again at the end of 2024 discussing the predictions?

_

Analysis by Pexapark for the year 2023

Pexapark prepares us for 2024 with its market analysis for 2023 in Europe. Notably, changes in the global macroeconomic environment and the impact of increased renewable energy penetration in electricity generation have substantially reduced profits for renewable assets in recent years.

Firstly, the rise in interest rates had a more immediate effect, leading to a sharp decrease in fundraising for projects. According to Infrastructure Investor data, fundraising fell from 140 billion euros annually in 2022 to 27 billion euros in the first nine months of 2023.

The rise in interest rates brings an increase in the cost of debt. The 10-year Euribor (a quick note for those unfamiliar with the term: Euribor is the interest rate at which banks lend money to each other) reached a peak of nearly 3.9%, following an upward trend over the past 18 months. Nevertheless, the margins for lenders have reportedly barely changed, indicating continued banking interest in the sector. However, this growing cost of debt and capital, leads to higher discount rates used to value projects.

Secondly, long-term Power Purchase Agreements (PPAs) averaged around 60€/MWh in 2023, compared to an average of 90€/MWh in 2022 when the conflict in Ukraine drove electricity prices higher.

Thirdly, as more intermittent energy sources are integrated into the grid, it causes constantly increasing imbalance prices. Last year, the high volatility in electricity prices led to producer prices acting as Balancing Responsible Party (BRP) soaring to 7€/MWh. Although in 2023, balancing costs dropped to around 3€/MWh, they remain higher than the long-term average.

For renewable owners and operators, this development has manifested through increased market route costs and balancing costs. Given the state of the energy transition, elevated system costs are here to stay, becoming a fundamental consideration for renewable investment strategies.

_

Curiosity - Water drainage clips for pv modules

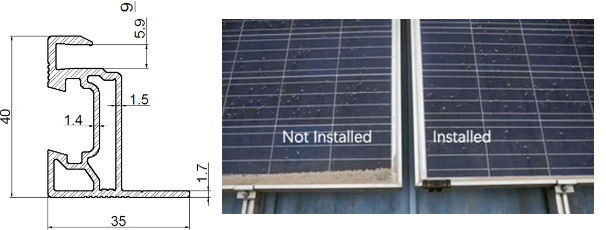

In this third section, I do not bring a piece of news, but a very basic invention that can make a significant difference. I am talking about water drainage clips, a plastic or metal piece anchored to the bottom frame of photovoltaic modules to facilitate the capillary drainage of accumulated water on them.

The small height difference between the glass and the module frame, however small it may seem, can cause water and tiny solids to accumulate at the bottom during rain. Thus, shading at the bottom will limit the module's current and even that of the entire string (Remember that the string's current will be limited by the module with the lowest current).

With such a simple invention, a problem that could jeopardize long-term production is solved. Another option would be to regularly clean the modules, but I think there is no need to compare the costs of both options. Certainly, an investment to consider for installations with a lower inclination, such as those installations with roof inclination. Did you already know about drainage clips?

Video rights of SUD Renovables

_

Union of manufacturers to standardize 700 W modules

As we saw in July of last year in Solarletter #4, major Chinese manufacturers reached an agreement to standardize the dimensions of photovoltaic modules to 2,382 mm in length and 1,134 mm in width. This move aimed to optimize the logistics and design of the modules in installations.

Just before Christmas, it seems they have come to an agreement again to standardize the dimensions of the next-generation modules. In Solarletter #7, we already discussed how Trina Solar took the first step towards the race for 700 W modules, using TOPCon technology and 210 mm wafers, after testing them in a multi-megawatt photovoltaic park.

Trina Solar is now leading the Photovoltaic Open Innovation Ecological Alliance, which includes major manufacturers such as Astronergy, Canadian Solar, Risen Energy, TCL Zhonghuan, and Tongwei. The alliance aims to standardize modules with dimensions of 2,384 mm in length and 1,303 mm in width. Additionally, the holes in the vertical back frame are also standardized with distances of 400 mm and 1,400 mm between them, with others added at 790 mm.

Seen on PV-Magazine, by Anne Fischer.

_

Edition´s microtip

In this edition, I wanted to delve into something more technical and, at the same time, revisit some concepts that were starting to fade from my memory. So, what better way than to try to explain it to someone else. Is it necessary to protect the strings with fuses? Both poles, or is one enough?

The bibliography I usually turn to is a document from ABB that explains technical aspects of photovoltaic installations. I will leave the link here. To summarize and simplify things, it is important to know the current-carrying capacity of the conductor and what the short-circuit current will be in case of a fault.

In the simplest case, a string connected to an MPPt will not require a fuse if the cable's current-carrying capacity is 25% greater than the string's short-circuit current:

However, this is not usually the case in large photovoltaic parks, where two or more strings are almost always connected to the same MPPt (in the case of string inverters) or where DC combiner boxes are often used (in the case of central inverters). That is, when there are parallel connections, we need to know what the short-circuit currents will be (Isc1 and Isc2 for fault 1 or Isc3 and Isc4 for fault 2 in the graph below). These currents will be the sum of all the strings in parallel minus 1 (the string where the short circuit occurs):

On the other hand, although often overlooked, it is important to know what the maximum reverse current allowed by the module manufacturer is. Because even though the short-circuit current may not be harmful to the cable, it may be harmful to the module itself.

So, in the case of requiring protection against overcurrents, how do we choose them? For this, we should refer to the standard IEC 62548 - Photovoltaic (PV) arrays - Design Requirements. It is important when choosing protection:

Fuses should be of the gPV type according to the standard IEC 60269-6.

Voltage ratings should be above the maximum system voltage.

The IP sealing of the fuses must be suitable for their place of installation.

Maximum temperatures should be considered for locations with extreme atmospheric conditions.

The nominal current of the fuse should comply with the following equations:

Certainly, this can get even more complicated, as I have only explained whether strings need to be protected with fuses or not. There are other options, such as grouping multiple strings under the same protection, using circuit breakers instead of fuses, blocking diodes, the contribution of short-circuit current from the inverter, etc. Not everything was going to be so straightforward and easy.

That concludes the edition. I hope you enjoyed and it made your coffee break, public transportation ride, or nap more enjoyable. If you have any suggestions, recommendations, or comments, feel free to reply to this email.

If you liked it, help me give it a boost by sharing it on your social media, with your friends, or coworkers. And if you did not like it, I apologize, but returns are not accepted.

Sunny Regards!